Nykaa | Engagement & Retention project

Nykaa - The E-commerce multi brand start-up which has been slaying the beauty, Personal care and fashion domain right from the beginning

Nykaa is an E-commerce stores which house for wide range of beauty and wellness products from India and abroad The inspiration behind the name "Nykaa" is taken from Sanskrit which is "Nayaka" and it means the one in the spotlight

Founded in 2012 by Falguni Nayar as a beauty and wellness commerce platform, it soon became a beloved neighbourhood brand for all their Beauty & Personal care (BPC) including skin & haircare, bath & body as well as for fashion, accessories, health & wellness needs

Some Quick statistics on Nykaa:

- Nykaa is the largest player #1 in beauty & personal care (BPC) with 38% market share

- Nykaa offers over 6250 brands across BPC and fashion with over 7.5 mn SKU's to select from

- With around INR 10K crores in Gross merchandise value Nykaa has clocked a 70% CAGR growth over last 5 years - One of the fastest in e-commerce brand of its size

- Nykaa has ~40 mn montly unique visitors on its platform with ~13 mn annual unique transacting customers (~25% Y-o-Y growth)

- Nykaa is now an omni-channel brand with 154 stores in 60+ cities

Simply put, Falguni decided to organize an unorganised beauty market which only existed in offline trade by becoming a one stop solution for for beauty and wellness enthusiasts by providing an extensive selection of brands and products

To understand Nykaa's model better, let's look at a quick S.W.O.T which will help us drive the engagement and retention strategies later:

Strengths | Weakness | Opportunities | Threats |

|---|---|---|---|

Strong distribution network | Redressal of grievances | Exploding BPC market | Rise in competition - TIRA |

Inventory based model | Waste management | Growing E-commerce base | Use of technology to disrupt BPC |

Diverse product portfolio | Employee satisfaction | Higher standard of living | Supply chain disruptions |

Multi brands | Compliance issues | Collaborations and partnerships | Shift to D2C brands |

Content led engagement | | Geographical expansion | Changing preferences |

Brand presence | |||

Strong social media iteraction & collaborations |

Understanding the Core Value Proposition of the product

Nykaa provides customers convenient and comprehensive omni-channel shopping experience for Beauty and Personal care products, Fashion & Accessories, wellness and others from the huge inventory of high quality products and brands making the delivery logistics seamless and accessible through mobile app / website.

Majority of the product share lies in BPC category (70%) followed by Fashion as seen below:

Source: Nykaa's annual integrated report FY23 (https://www.nykaa.com/media/wysiwyg/2021/Investors-Relations/pdfs/Integrated-Report-2022-23.pdf)

How does Nykaa differentiate itself from others? Let's understand this from 5 P's KA PUNCH 👊

- Partnerships & Exclusivity: Nykaa collaborates with 7000+ brands including both Indian and International across BPC, Fashion and other category. This makes them the most comprehensive offering in the segment when compared to any other E-commerce / offline BPC player. Cheery on the cake, there are some brands which also offer exclusivity for distribution to Nykaa in India

- Platform convenience + Physical stores: While 95%+ of the distribution is still online, Nykaa offers as an added touch with omni-channel presence of 154+ stores in India. Virtual try on, Personalised recommendations, clean experience with beauty advisory and interactive journey help keep the user engaged on the online platforms

- Pricing advantage: Being the largest distributor in the segment, Nykaa definitely passes on some exciting offers / discounts to the customers. This is generally bundled with festive days, Mid year beauty fiesta sale, exclusive brand launches, freebies offered above a certain order value etc.

- Personalization for enhanced customer experience: Though models like Nykaa beauty bar, Nykaa tries to offer personalised consultations and makeover for beauty enthusiasts. Recommendation offered basis strong data analytics is also strong hook for the customers. ModiFace their virtual try on technology helps them stay relevant in today's context / competition. they gave

- Product Inventory: Owning the product inventory helps Nykaa bring in efficiencies in faster delivery, quality check as well as standardised packaging for superior customer experience. Plus that free serum, shampoo, moisturiser or any other sachet added to the package always gets a smile on customers face right.

Source: Nykaa's annual integrated report FY23 (https://www.nykaa.com/media/wysiwyg/2021/Investors-Relations/pdfs/Integrated-Report-2022-23.pdf)

What is the Engagement & Retention metric for Nykaa?

Now that we know the core value proposition of Nykaa, what makes you an active customer for Nykaa?

Active customer: Anyone who used Nykaa to place at least 2 orders in a year in any of the categories including under BPC qualifies to be an active user.

Rationale: BPC continues to be ~75% of Nykaa's distribution and represents the brand image / positioning in the market

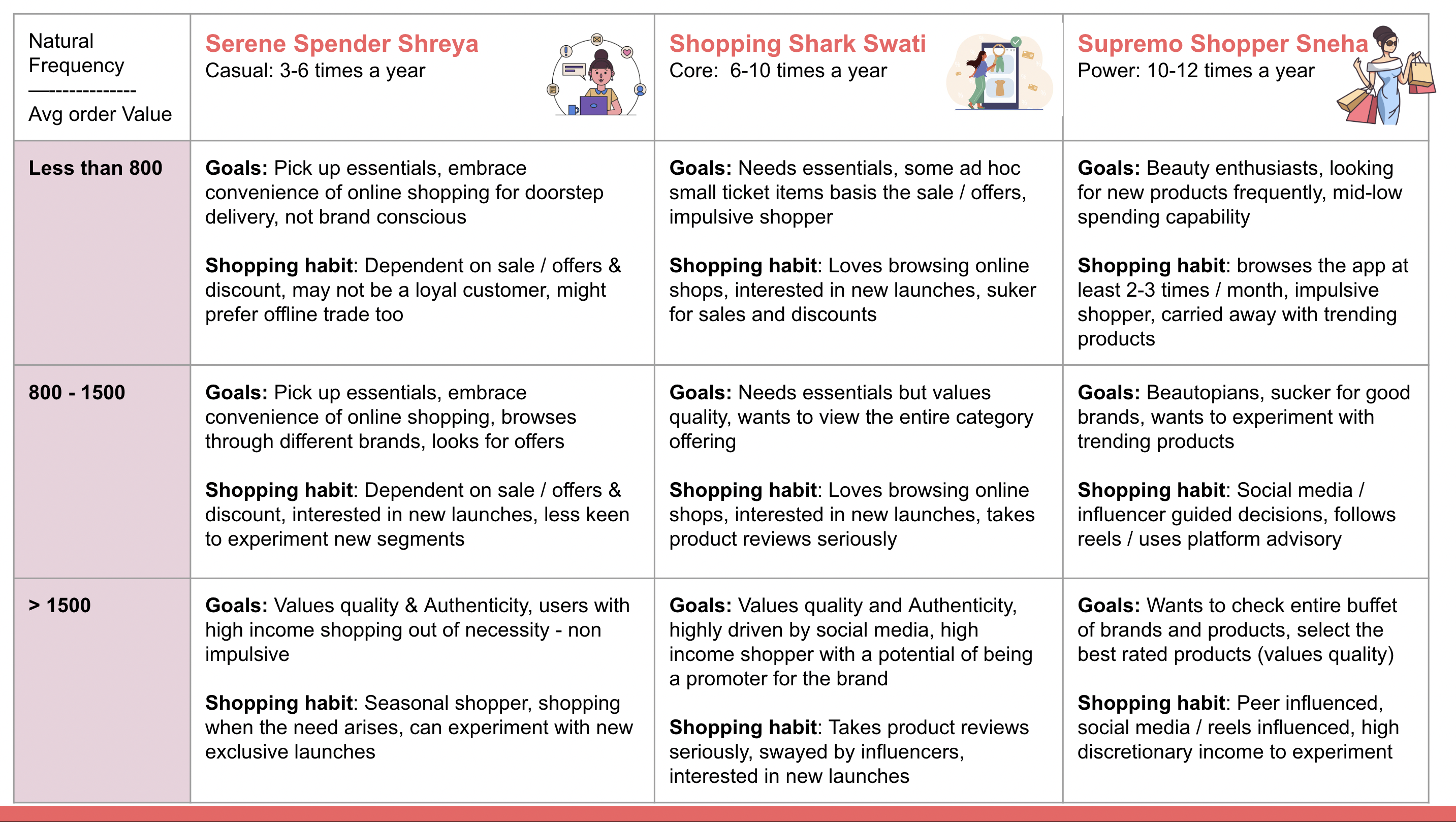

Given the Nykaa landscape, we will be dividing the user into two axes:

- Frequency of orders: This is nothing but the natural order frequency of eirther BPC or fashion products by the user on Nykaa platform

- Average order value: This shows the depth of engagement of each user

Basis the above, active users are plotted in each of the category with some traits of their need as well as their shopping habits.

Now that we know some traits as well as nature of interaction of the active users, let us see what how d the existing customer of Nykaa look and behave like.

For this we conducted a survey with 37 users who currently use Nykaa / have previously used Nykaa to share their views (https://forms.gle/EfHCQnzcEsEJkzi97). In addition, i have spoken to 15 folks in person to understand the following:

- Online shopping behaviour (particularly in BPC / fashion segment)

- Customer demographics correlating to the behaviour

- Nature of engagement with the product

- The big influencing factors in selecting the product as well as some blockers

With this, let's look at some of the insights received:

- Most active shoppers (>6 times a year) are in the age bracket of 25 - 35 with an avg income levels of ~15 - 20 lacs / annum

- ~25% of the respondents were in the age group above 35 (majority below 45), showing the signs of shopping less than 6 times a year but with an average order value of ~2500+

- 35% of the respondents were male, where the major shopping category for them is Skin and hair care, fragrances etc.

- Coupons & discounts, Wide variety of products online, convenience to shop and faster delivery are the top 4 reasons for folks to shop online (96% of them are online shoppers)

- While 100% of the users have shopped from Nykaa, 28% of them have also shopped from Tira, 26% of them have also bought BPC produts from Amazon / Myntra and the a few of them have also used Puplle as well as D2C brands like Mamaearth / sugar cosmetics.

- 50% of the respondents use Nykaa once a month, 30% of them once / twice in 3 months and 20% of them once in 6 months

- 98% of the users have downloaded Nykaa app and shop from the app

- Makeup, skincare, hair care are the dominant segments for shopping for the users

- Offers & Discounts, Quality of products, delivery timelines, user advisory tools, Modiface tool, campaigns, influencer campaigns, stronger brand confidence are the top reasons for respondents to shop from Nykaa - majorly BPC segment

- Other mainstream e-commerce platforms (like amazon), higher discounts & offers, faster delivery, unavailability of a product, offline trade like Sephora, Tira and competition in fashion segment from the likes of Myntra, Ajio are some reasons for people to shop other than Nykaa.

With this insights let's draw 3 sample ICP's again Based on the same user cohort as seen above:

# | ICP 1 Serene spender - Casual | ICP 2 Shopping Shark - Core | ICP 3 Supremo shopper - Power |

|---|---|---|---|

Name | Yashna | Shefali | Miloni |

Age | 30 | 40 | 34 |

Income band | 20 lacs | >20 lacs | >60 lacs (Household income) |

Occupation | Financial analyst at an MNC | Self employed - Runs her own food kitchen | Home maker |

Gender | Female | Female | Female |

City | Delhi | Mumbai | Mumbai |

Marital status | Married | Married | Married |

Kids | No kids | 2 kids over 10 years of age | 1 infant & 1 Pre-schooler |

Lifestyle related traits | |||

Income levels | High | Medium | High |

Time available | Low | Medium | Low |

Money or Time | Money | Money | Time |

Other apps used | Myntra, Amazon, Ajio, OTT (netlfix etc.), Zomato, Ola Linkedin, Ken, ET money, Make my trip,, Phonepe etc. | Netflix, Youtube, Facebook, Instagram Nykaa, Zomato, Swiggy, Paytm, HDFC bank etc. | Myntra, Ajio, Netflix, Instagram, Youtube, Swiggy, Uber, Baby center, Hotstar, Zara & HnM, Paytm |

Weekend activity | Travel, reading books, watching movies enrolled into some course, exploring new restaurants | Visiting new restaurants, spending time with family visiting malls and theatres, schooling kids | Socialising with friends, taking the kids out, visit malls & restaurants, watch movies on OTT |

Influencer impact | low to medium | High | High |

Kind of influencers followed | Finance experts, health and wellness coach, celebrities, travel bloggers | Food blogger, Chefs, Travel, health and Lifestyle | Fashion & Travel bloggers / influencers, Parenting tips top stylists, celebrities |

Social media activity level | Medium | High | High |

Time spent on scrolling reels | 20 mins / day | 40-50 mins / day | 45 mins to 60 mins / day |

Tech savvy level | High | Low to Medium | Medium to High |

Engagement related traits | |||

Online shopper | Yes | Yes | Yes - less time for offline shopping |

Online vs offline ratio | 90:10 | 50:50 | 80:20 |

Prefers App / website | App | App | App |

Current platforms used | Amazon, Myntra, Ajio, Westside etc. | Myntra, zara, HnM, Westside, Pepper fry, Ikea | Ajio, Myntra, Nykaa, D2C (Zaram, HnM, kama etc.), Amazon |

Reasons for shopping online | Convenience of door step delivery Given low spends on shopping, less need to visit offline stores Higher discounts and offers Time saved | Variety of products available Referred by friends Discounts and offers pass time browsing | Convenience to shop at home Easy return policy Offers and discounts Variety of products |

BPC products ordered from | Nykaa, Myntra | Nykaa, Ajio, Amazon, Kama | Nyaa, Myntra, Ajio |

Reasons to shop BPC online | Limited items to be ordered Once in 3-4 months Know the products to be ordered - just the pricing needs to be compared | Higher discounts Delivery of essential items like moisturiser not available nearby | Less offline options comparatively lack of options offline (less SKU's) Offers and discounts Loyalty points |

Pricing vs Brand | Pricing | Pricing | Brand and quality conscious |

Top reasons to shop from Nykaa | Better offers Trust the quality Faster delivery | Better offers Big brand - one stop shop for all BPC Easy and quick delivery | One stop shop for major brands Platinum member free delivery Trusts the quality |

Avg order value | 800 - 1000 | 1200 - 1500 | 2800 |

Avg order frequency | 4 - 6 times / year | 6 - 8 times / year | 10 - 12 times / year |

Top categories ordered from Nykaa | Skin and hair care, make up | Make up, Skin and hair care | Make up products, Hair and skin care, accessories |

Nykaa member level / status | Prive | Prive Gold | Prive Platinum |

Overall Nykaa satisfaction score | 7 / 10 | 8 / 10 | 9 / 10 |

Would you refer Nykaa? | Not sure | Depends on the incentive on referral | Definitely |

Retention | |||

JTBD for Nykaa | Has the product available at the right price in the right delivery timeline for Yashna | Look for particular BPC products used, additionally shops a few other items basis recommendations Expects a quick delivery | A platform which works like a personal stylist comprehensive range of beauty products available to browse and shop from Quick delivery of products |

Pain points | Lower discounts out of stock no need to specially visit the app - can club with my other Myntra order | Higher delivery time product out of stock shopped from offline trade | Out of stock products, long delivery timeline Higher price, added beauty products as part of the total order on other app |

Reasons to shop from other platforms than Nykaa | Better discounts and offers | Offline trade, competition offering | Better offers, new exclusive brands on other platforms D2C tried |

Decoding the Engagement framework basis the ICP breakdown

Before we move to the selection of engagement framework, let us look at all the actions that a user performs on Nykaa:

- Browses through the entire BPC catalogue including Make up, skin & hair acre etc.

- Double clicks on any of the sub category products

- Checks out the first / initial few pages on each product offering

- Plays with some filters to select brand, price range, discount etc.

- completes entire checkout process

- Spends time on engagement with personalise experience page: views recommendation basis users inputs on his / her own details

- Views the loyalty membership 'Prive' criteria and benefits

- Visits the top offer page / mega sale page

- Reads through the return /exchange policy

Some of the critical metrics / KPI for Nykaa basis above user actions would be as follows:

- Daily active users / monthly active users

- Add to cart %: no of user adding products to the cart

- Conversion rate %: no of user actually buying post registration / onboarding

- Product density per customer: no of products / categories purchased by one customer

- Revenue per user as well as Customer lifetime value

- Net promoter score

Selecting the right engagement framework (Finally 😁:)

Increasing Frequency and AOV is critical and hence the engagement strategy to be focused on frequency and Depth of engagement. The more user spends time on the platform, the more he explores the product catalogue

Campaigns, Campaigns & Campaigns to improve Engagement!

Campaigns are designed keeping the 3 ICP's in mind (ICP detailing as mentioned above). Focus is to move the Frequency needle for both casual and core users (Yashna and Shefali) while focusing on increasing the depth - Avg order value for power user (Miloni)

Some more engagement campaigns outside the ICP's detailed above:

To address the proposed engagement pitches, below are some sample / mock designs created:

- Beauty Fiesta GIF to be shared on whatsApp:

- Re-activation for a Serene spender - to be shared both on email and WhatsApp!

Retention: Jaane nahi denge tumhe 🤗

Before we dive into Nykaa's retention strategy, let's look at some quick numbers:

- Nykaa has 15 mn social media followers

- With 30% growth in annual avg unique transacting customers, Nykaa has ~13 mn annual unique transacting customer across BPC, fashion and other segments

- With 41 mn orders placed annually, avg order per customer comes to ~3.1

- ~40 mn unique customers visit Nykaa on monthly basis, ~3 mn orders / transactions are done

Cumulative customer base of Nykaa is ~24 mn as on 31st March'2023. With 13 mn unique active customers the current retention comes to: 13 / 24 = 54%

Source: Nykaa annual integrated report FY22-23 (https://www.nykaa.com/media/wysiwyg/2021/Investors-Relations/pdfs/Integrated-Report-2022-23.pdf)

There is significant opportunity in both activating higher customers as well as improving the activity is active customers. For retention / resurrection, we will look at the following goals:

- Focus on Churn - customers who were active for one transaction but are not active for more than 6 months on the product. Assuming 6 months because the least active customer uses Nykaa at least 2 -3 times a year

- Focus on retention - Creating hook for the customers to continue on Nykaa with higher frequency

Which are the customers that drive the best retention?

- Shefali (Core) and Miloni (Power): Both core and power users have the frequency of ordering higher than the avg customer frequency. Their AOV is higher than average again. They are also the potential promoters for the product to acquire moe customers

- Miloni (Power): Power users are loyalists / Beautopians for Nykaa. They are willing to experiment across the breadth of offerings as well as increase the ticket size in their order depending on the engagement hooks created for these user

Basis the user interaction, let's understand some features driving retention for Nykaa:

Features | Impact |

|---|---|

Competitive pricing & offers | High |

Wide variety of products | High |

Multiple brands available to shop from - Domestic & International | High |

Inventory based model - better control on quality & delivery | High |

Seamless and quick delivery | High |

Most comprehensive offering in BPC segment | High |

Top brands as well as some exclusive brands partnered | High |

Try on! AI powered technology to live try products on your face | High |

Sharp segmentation of categories | Medium |

Loyalty program - Membership tiers and related benefits | High |

Easy UI on the application | High |

Authentic Product reviews and ratings | High |

Affinity towards the brand ambassadors promoting the product | High |

Referral design | Medium |

Gamification of reward points on shopping | High |

Churn: customers who were active for one transaction but are not active for more than 6 months on the product. Assuming 6 months because the least active customer uses Nykaa at least 2 -3 times a year

Some reasons for churn are listed below:

Voluntary churn | Involuntary churn |

|---|---|

Quality issues for the product delivered | Moved out of the serviceable location |

Poor customer service | Purchase decision maker changed - now managed by wife |

New technology by the competitors - TIRA | |

Issues in return and replacement | Death |

Better offers / pricing on other platforms / offline stores | Apps like Amazon offering most user requirement on one app - hence purchase made in one integrated journey with multiple products |

Delay in delivery | Inability to pay - financial circumstances |

Issue with User experience on the app | Close affiliation to an offline store near me |

Unavailability of product | |

Gimmicky festive sales with no real deal | |

Inefficient loyalty program | |

What are some negative actions indicated by the churned user?

- Application uninstalled: 98% of Nykaa's online shopping is done through app. any user deleting the app is the 1st / most critical sign of churn

- Hibernating for more than 6 months: Avg active customer places an order with Nykaa once every quarter. User not being active for more than 6 months shows the user opting for alternate choices

- High session time with no purchase: user spending high time on app browsing for product without making an purchase can be sign of products being compared to other platforms with no closure on Nykaa

- Cart abandoned: Products are added to the cart but not purchased. this could be a sign of user opting for competition offering

- Reduced frequency of ordering: User reducing the order frequency from their previous shopping history / compared to avg frequency

- Reduced average order value: User reducing their avg order value from their previous shopping history / compared to avg frequency

- Reduced session time: User reducing their session time than previous average / natural average

- Muting of notifications: User is getting disoriented from the updates being shared

- Gave a poor product review: User who faced a poor experience sharing the same online

- Increased returns and refunds: users increasing the returns showing unpleasant interaction and experience with the product. Likely to move to competition

With this, let's look at some Resurrection campaigns:

Hope you enjoyed reading this as much as I enjoy shopping on Nykaa!

THANK YOU!

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.